wat0n

ya lo encontre

- Se incorporó

- 21 Agosto 2004

- Mensajes

- 2.689

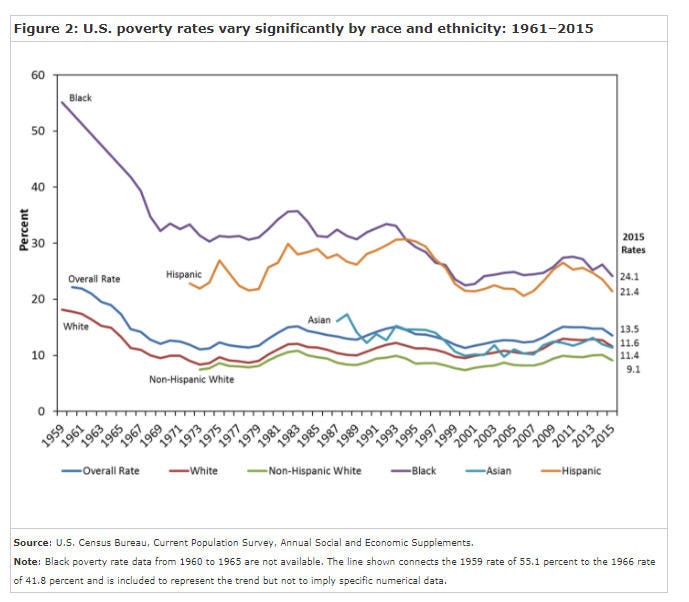

Y sin embargo tienen menos credit score, por que? la raza?

Digo no racismo, es por que por raza tienen peor comportamiento con los bancos?

Por qué será? No será que es porque son más pobres? No puede ser que no tienen tanta historia crediticia, lo que hace que sean más riesgosos? No podrá ser que tal vez su empleo es más sensible al ciclo económico? Creo que puede haber varias explicaciones.

Y bueno, también está este estudio un tanto antiguo de la Fed sobre este tema. En este caso tomaron 3 credit scores diferentes y los normalizaron para comparar (así que una diferencia entre afroamericanos y blancos de 1 significa que hay 1 percentil de diferencia en los puntajes promedio entre ambos):

...

The Distribution of Credit Scores

Mean score, median score, standard deviation of score, and the proportion of individuals in the lowest score deciles vary widely across subpopulations and across the three credit scores (tables 14.A--C and figures 2.A--C). Differences in credit scores among racial or ethnic groups and age cohorts are particularly large. For example, according to self-reported (SSA) data on race or ethnicity, the mean TransRisk Score for Asians is 54.8; for non-Hispanic whites, 54.0; for Hispanics, 38.2; and for blacks, 25.6. The proportions of the subpopulations in the lowest two score deciles also differ greatly: The proportions of the subpopulations in the lowest two score deciles is, for Asians, 12.3 percent; non-Hispanic whites, 16.3 percent; Hispanics, 30.1 percent; and blacks, 52.6 percent. Foreign-born individuals appear to have a score distribution similar to the general population, with a smaller representation at the extremes of the distribution.114

When the racial composition of the census block is used as a proxy for the race or ethnicity of the individual, the differences in scores across groups, although still substantial, are smaller than when the individual's race or ethnicity derived from SSA data are used. For example, when the census-block proxy for race is used, the mean difference in the TransRisk Score between blacks and non-Hispanic whites falls from 28.4 points to 15.1 points.

...

Hay bastante variación individual metida en esto.

Además, la diferencia empieza a caer al considerar controles:

...

The sample used for the multivariate estimation was reduced 11 percent by excluding individuals with unknown age or census tract. As shown in table 15, panel A, the gross difference between non-Hispanic whites and blacks for the TransRisk Score in the multivariate estimation sample was 28.3 credit-score points (54.0 minus 25.6 with rounding). The difference between non-Hispanic whites and blacks declines to 22.8 points when marital status and age are accounted for; the difference falls to 18.7 points when census-tract income and the estimated income of the individual are taken into account. Accounting for the mean census-tract credit score causes the difference to fall further, to 13.4 points. The gross difference in mean TransRisk Scores between Hispanics and non-Hispanic whites (15.7 points, again with rounding) falls relatively more than for blacks and non-Hispanic whites; after accounting for all factors, only a 3.9 point differential remains unexplained.

When the census-block proxy is used to identify the race or ethnicity of individuals, a similar reduction is observed in the differences across racial or ethnic groups once other factors are taken into account (table 15, panel B). These results differ from those using individual race or ethnicity; however, differences in that gross score and the differences that remain after all available factors are taken into account are smaller. For example, the analysis using the census-block proxy for race or ethnicity finds an unexplained difference of 2.5 points between non-Hispanic whites and blacks. In contrast, an unexplained difference of 13.4 points remains between these two groups when the individual's race or ethnicity is used in the analysis.

...

Cabe mencionar que no tenían datos a nivel individual de ingresos (por ejemplo) así que usaban el ingreso promedio del tracto censal (es como el barrio) por raza y otros factores para imputar. Lo de arriba implica que esa información individual faltante es de hecho importante.

Y esto está interesante:

...

Overall Performance

Regardless of the specific performance measure considered, each of the three credit scores used in this study predicts future loan performance: Figure 5 displays the actual average performance at each credit-score level for the three scores and for the five measures of performance. As shown, the percentage of bads consistently decreases as credit scores increase for all three scores and for all five measures of performance. The performance of those in the bottom 30 percent of the distribution differs substantially from those above that level. For example, for the TransRisk Score, 78.4 percent of the individuals with credit scores in the bottom three score deciles had at least one account go bad over the performance period, while only 1.8 percent of individuals in the top 30 percent of the score distribution had an account go bad.

Another way of illustrating the predictiveness of the scores is to plot the cumulative distribution of goods and bads by score (as shown earlier in figure 1). For each score and for each performance measure, the cumulative distribution of the bads is considerably to the left of that of the goods, a confirmation that the scores have considerable predictive power.

The poor performance of individuals in the lowest portion of the credit-score distribution warrants closer attention. The potential losses from extending credit to individuals in this credit-score region appear to be substantial. For example, the random-account performance measure indicates that 52.7 percent of new or existing accounts extended to individuals in the bottom 20 percent of the score distribution would be expected to go bad over an 18-month period. Not all of this poor performance necessarily reflects lender decisions on newly extended credit because it also potentially reflects deteriorating performance on existing accounts, which are those opened before the beginning of the performance period. However, credit-record data indicate that 17.9 percent of the individuals in the bottom two score deciles of our sample were extended credit in the last six months of 2003 (modified new account) and that about 16.1 percent of these accounts defaulted. Under the presumption that lenders screen for credit risk, the high incidence of bad performance in the two lowest deciles likely would have been even higher had more individuals in these low score deciles been extended credit.

Performance by Population Group

Credit scores appear to differentiate risk well within all population groups (figures 6.A--E; data given are only for the TransRisk Score, as the data for the other two scores are similar). The general shapes of the performance curves are similar across groups, as is the separation of the goods and bads (figures 7.A--E; again, data only for the TransRisk Score are shown). Within populations, the performance curves are not identical. Of particular interest for this study are performance curves for populations that are uniformly above or below that for others. A performance curve that is uniformly above (below) means that that group consistently underperforms (overperforms), which in turn means that the group performs worse (better) on their loans, on average, than would be predicted by the performance of individuals in the overall population with similar credit scores.

...

La diferencia probablemente tenga que ver no con algo inherente con la población afroamericana si no que puede que haya otros factores individuales que les afectan más y que no están en la base de datos que usaron. Por ejemplo, si son más pobres en promedio y el efecto del ingreso no es lineal, puede estarse omitiendo información relevante para entender qué onda con eso.